From the DOJ: “Employers have a legal responsibility to collect and pay over to the Internal Revenue Service (IRS) taxes withheld from their employees’ wages. These employment taxes include withheld federal income tax, as well as the employees’ share of social security and Medicare taxes (FICA) Employers also have an independent responsibility to pay the employer’s share of FICA taxes.

When employers willfully fail to collect, account for and deposit with the IRS employment tax due, they are stealing from their employees and ultimately, the United States Treasury. In addition, employers who willfully fail to comply with their obligations and unlawfully line their own pockets with amounts withheld are gaining an unfair advantage over their honest competitors.”

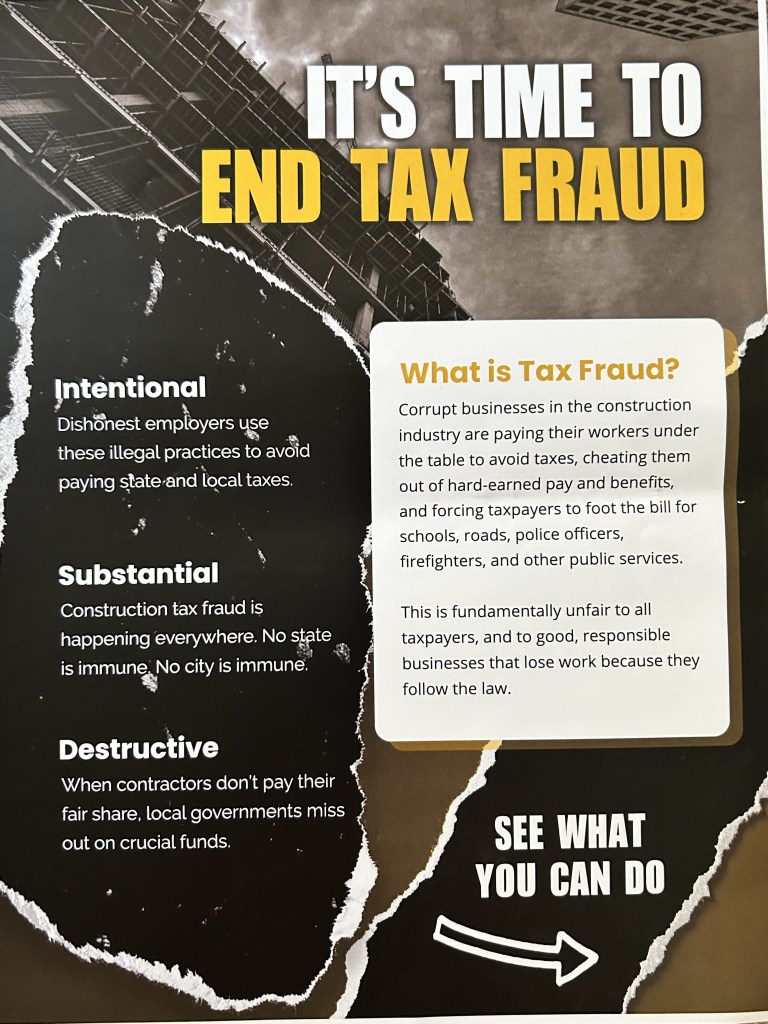

The Indiana/Kentucky/Ohio Regional Council of Carpenters held a demonstration at the Porter County courthouse lawn to bring awareness to the real issue of payroll tax fraud. What can you do?

Look Around, Speak Out, Educate, Show Up, Support Local and Take it to the Top. Check out the literature attached to this post.

Leave a comment